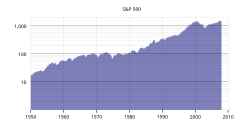

Just running some compound interest formulas over Christmas break and seeing what one should expect if one saves and invests wisely over a lifetime. These formulas assume a 10% yearly return which is hardly impossible, the stock market gained 20% last year and Warren Buffett averages 18% per year. It also assumes a lifespan of 80 years and begins at age 30, so 50 years, with 35 possible working years.

Years of work Total return Invested/Yr

1 $55,000.00 $50,000.00

2 $116,600.00 $51,000.00

3 $185,482.00 $52,020.00

4 $262,396.64 $53,060.40

5 $348,170.07 $54,121.61

6 $443,711.52 $55,204.04

7 $550,021.61 $56,308.12

8 $668,201.48 $57,434.28

9 $799,462.90 $58,582.97

10 $945,139.28 $59,754.63

11 $1,106,697.90 $60,949.72

12 $1,285,753.28 $62,168.72

13 $1,484,081.90 $63,412.09

14 $1,703,638.46 $64,680.33

15 $1,946,573.63 $65,973.94

16 $2,215,253.76 $67,293.42

17 $2,512,282.35 $68,639.29

18 $2,840,523.86 $70,012.07

19 $3,203,129.79 $71,412.31

20 $3,603,567.38 $72,840.56

So after twenty years of work and investing $50,000 per year (plus 2% increase per year due to cost of living increases and inflation) you would have $3,603,567.38. If you retired on this day and decided to live on an income of $200,000 a year, here is what you could expect with the same 10% yearly return on investment:

Retirement Yr Net Worth Yrly 'Salary'

1 3,603,567.38 200,000.00

2 3,763,924.12 200,000.00

3 3,940,316.53 200,000.00

4 4,134,348.18 200,000.00

5 4,347,783.00 200,000.00

6 4,582,561.30 200,000.00

7 4,840,817.43 200,000.00

8 5,124,899.18 200,000.00

9 5,437,389.09 200,000.00

10 5,781,128.00 200,000.00

11 6,159,240.80 200,000.00

12 6,575,164.88 200,000.00

13 7,032,681.37 200,000.00

14 7,535,949.51 200,000.00

15 8,089,544.46 200,000.00

16 8,698,498.90 200,000.00

17 9,368,348.79 200,000.00

18 10,105,183.67 200,000.00

19 10,915,702.04 200,000.00

20 11,807,272.25 200,000.00

21 12,787,999.47 200,000.00

22 13,866,799.42 200,000.00

23 15,053,479.36 200,000.00

24 16,358,827.30 200,000.00

25 17,794,710.02 200,000.00

26 19,374,181.03 200,000.00

27 21,111,599.13 200,000.00

28 23,022,759.04 200,000.00

29 25,125,034.95 200,000.00

30 27,437,538.44 200,000.00

So, retire at 50 with $3.6M, spend the next 30+ years living off an income of $200,000 on a beach somewhere in Florida. Sounds groovy, no?

Years of work Total return Invested/Yr

1 $55,000.00 $50,000.00

2 $116,600.00 $51,000.00

3 $185,482.00 $52,020.00

4 $262,396.64 $53,060.40

5 $348,170.07 $54,121.61

6 $443,711.52 $55,204.04

7 $550,021.61 $56,308.12

8 $668,201.48 $57,434.28

9 $799,462.90 $58,582.97

10 $945,139.28 $59,754.63

11 $1,106,697.90 $60,949.72

12 $1,285,753.28 $62,168.72

13 $1,484,081.90 $63,412.09

14 $1,703,638.46 $64,680.33

15 $1,946,573.63 $65,973.94

16 $2,215,253.76 $67,293.42

17 $2,512,282.35 $68,639.29

18 $2,840,523.86 $70,012.07

19 $3,203,129.79 $71,412.31

20 $3,603,567.38 $72,840.56

So after twenty years of work and investing $50,000 per year (plus 2% increase per year due to cost of living increases and inflation) you would have $3,603,567.38. If you retired on this day and decided to live on an income of $200,000 a year, here is what you could expect with the same 10% yearly return on investment:

Retirement Yr Net Worth Yrly 'Salary'

1 3,603,567.38 200,000.00

2 3,763,924.12 200,000.00

3 3,940,316.53 200,000.00

4 4,134,348.18 200,000.00

5 4,347,783.00 200,000.00

6 4,582,561.30 200,000.00

7 4,840,817.43 200,000.00

8 5,124,899.18 200,000.00

9 5,437,389.09 200,000.00

10 5,781,128.00 200,000.00

11 6,159,240.80 200,000.00

12 6,575,164.88 200,000.00

13 7,032,681.37 200,000.00

14 7,535,949.51 200,000.00

15 8,089,544.46 200,000.00

16 8,698,498.90 200,000.00

17 9,368,348.79 200,000.00

18 10,105,183.67 200,000.00

19 10,915,702.04 200,000.00

20 11,807,272.25 200,000.00

21 12,787,999.47 200,000.00

22 13,866,799.42 200,000.00

23 15,053,479.36 200,000.00

24 16,358,827.30 200,000.00

25 17,794,710.02 200,000.00

26 19,374,181.03 200,000.00

27 21,111,599.13 200,000.00

28 23,022,759.04 200,000.00

29 25,125,034.95 200,000.00

30 27,437,538.44 200,000.00

So, retire at 50 with $3.6M, spend the next 30+ years living off an income of $200,000 on a beach somewhere in Florida. Sounds groovy, no?

"Ah, you miserable creatures! You who think that you are so great! You who judge humanity to be so small! You who wish to reform everything! Why don't you reform yourselves? That task would be sufficient enough."

-Frederick Bastiat

-Frederick Bastiat