uziq wrote:

shilling is the part where you made out that the left-wing government were solely responsible for the state of greece's finances, or the generations-long culture of official corruption and giving favour (they hadn't even had 20 years of uninterrupted left-wing governance prior to the crash, so your selectivity is all the more blatant). your portrayal of europe as the instrument of fiscal (and thus moral) rectitude, tut-tutting at the corrupt left-wing national government, is a bit of a punt.

I said it started with the greek government committing fraud for over a decade. This has nothing to do with depicting the EU as an epitome of moral and fiscal prudence. It's a point on a government consciously deceiving its closest allies. Which in itself is bad enough, worse yet if it helps plunge an entire union in disarray.

Don't try and imply that I am blind to the faults of the union or the role of bankers in the financial crash because I didn't explicitly mention all possible contributing factors to the crisis. It's a weak attempt to obfuscate the moral low, the criminality, of a deeply troubled government. I ask again, how else should the other countries have responded, knowing the context of the situation they were in? Was it really such a great idea to pump money into that system? Beyond plenty theoretical objections there is no way anyone could've sold that concept in the rest of Europe. A massive budget was already being pumped into buying debt securities, funds that were paid for by the richer north. Sure, we can hold a discussion on solidarity and the changing regional and global concentration of capital and about the inherent unfairness of it all, but the fact of the matter is that we still live in a world of nation-states where few people are willing to bend over for other's interests. Not in the least if that is in the interest of a government that engaged in deceit. Nor was kicking Greece out of the monetary union acceptable (another possible solution), as that would've irreparably damaged the foundations of the Union and the trust countries can place in its institutions. Which, yes, is much more important than one member state's financial fumbling.

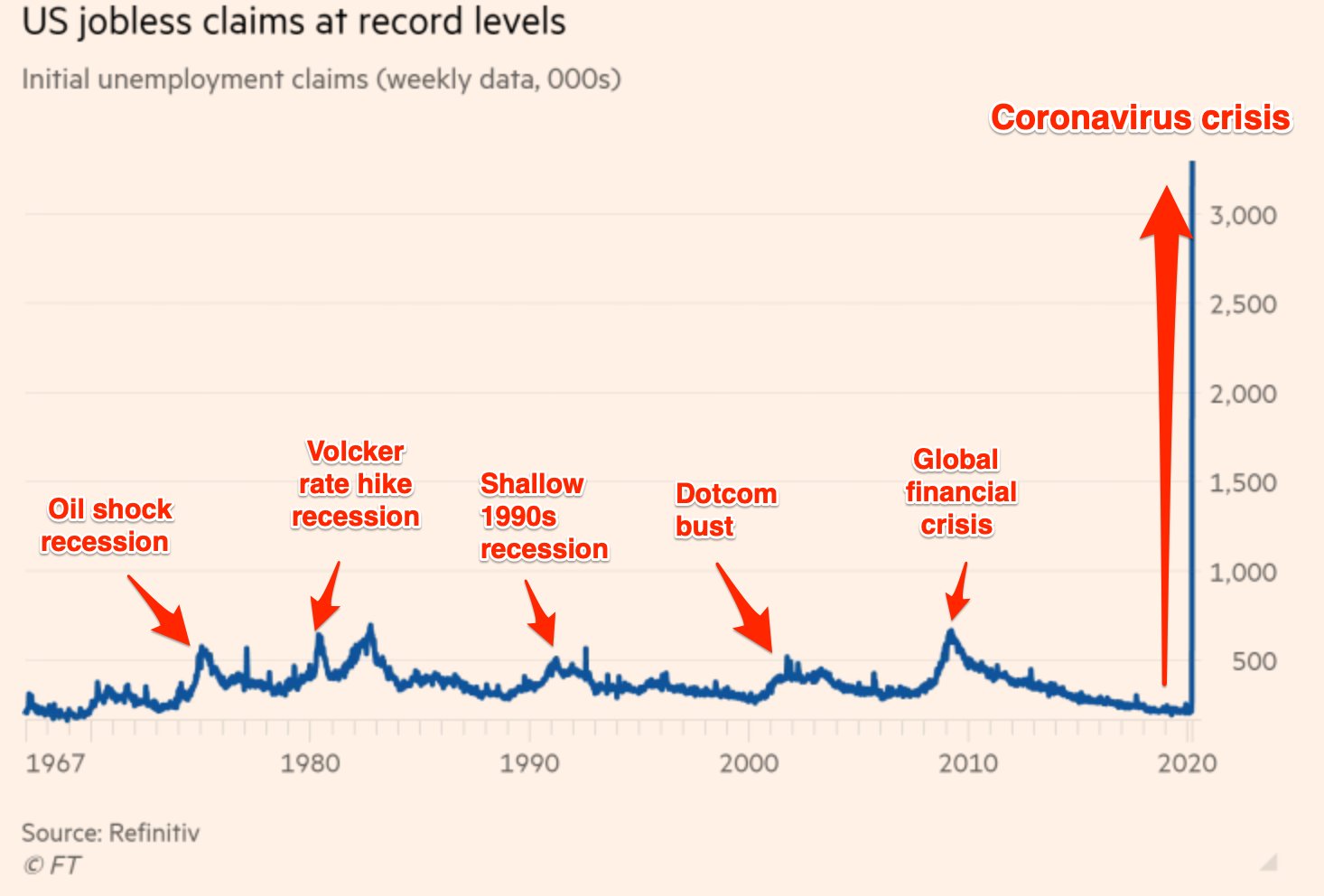

Even if we were perfectly capable of assigning blame with certain individuals and institutions and 'bring to justice' the key individuals, it would not have solved the crisis or prevented the greek citizenry from incurring financial blows. But the specific systemic causes of the financial crash and the eurocrisis between 2008-2012 were definitely addressed. That sort of mortgaging and trading is no longer permitted and that specific scenario in the union happening again is now highly unlikely. Yes of course there still definitely are flaws in the system (for which it would be hard to pinpoint specific individuals as guilty) so in the future we'll keep plodding along tumbling from crisis to crisis and dealing with the causes as they are exposed and become unmanageable.

I should add something to that last point - there's a set of 'intellectuals' who seem to be under the false impression that they figured out things noone else has or see things noone else sees, namely that the systems we live under have fundamental flaws and an almost inherent inequality to them and that crises about X, Y or Z issue is inevitable. They then propose 'revolutionary' revisions of capitalism or radical change, or keep to lamenting the supposed unsustainability of it all. The point I'd like to make to that is that the fundamentals of the capitalist system we have today were laid and invented (or sometimes just happened) in the age of colonialism, survived napoleon, survived the age of revolutions, two world wars, the soviet union, and a number of depressions that make our contemporary financial woes seem like lighthearted jokes. Evidently it's extremely resilient and not going anywhere. It certainly won't be impacted by some 21st century professor somewhere yet again regurgitating Marx's eternally decomposing corpse for the millionth time in the last 200 years. There's a naivete to it, but I guess those people have their role to play as well.

Ever so slowly, but surely, we'll deal with crises when we get to them and tipping points are reached. The global poor will have their moment vs the global rich and we'll figure out a way to deal with the next financial crash. It just doesn't happen overnight. People need to read a little more history and learn to be a little patient.

Last edited by Larssen (2020-03-26 10:54:24)