When they talk about double dip, imo they should qualify that statement with talking about a double dip in the stock market because the real economy is still going down, it has never even blipped or bumped upwards like the stock market. Here's a good employment graph, we are below historic recessions and the economy still hasn't bottomed yet. Even if you take unemployment to be a lagging indicator, it still hasn't turned and IMO employment will have to lead this recovery.

What has trended upwards slightly is the stock market because all the excess liquidity in the market is trying to find a spot to make money from money but no one is putting that money to work in the real economy. The market is so disconnected from the real economy that its value as an indicator of the health of the economy has to be questioned. The market has lost its real purpose which was to be a way for businesses to raise capital to put to work in their businesses.

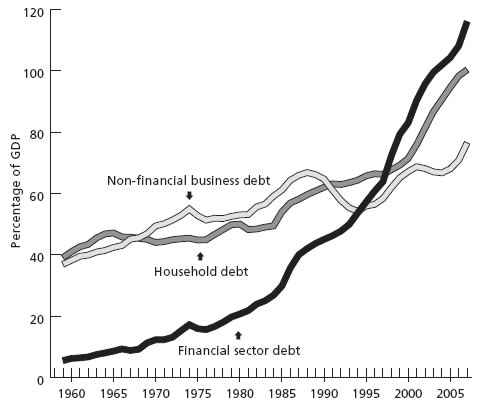

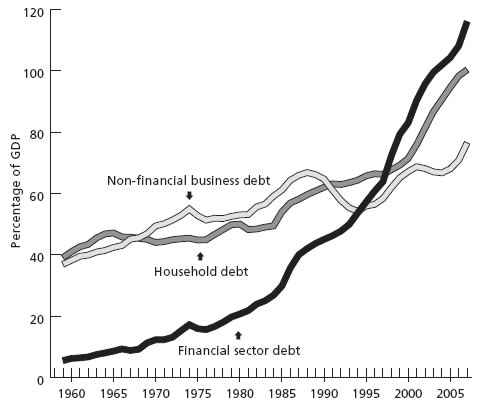

Here's the real problem

wOW what a rebound

the financial sector is the real problem. These are the guys who have had the recovery and its these guys that are in mind when the govt bails out the banks and offers a fed rate of zero. When it comes to talk of double dip its about these guys not regular people. The rest of us are just dog shit on their shoe, just sheep to be sheered.

And in this graph you can see a steady increase in the financial industry as a percentage of GDP although they don't add anything to the economy as far as real product. they are parasites and make money from money.

and here is another interesting trend line. notice how the growth in the economy has been debt based and that includes the financial system. The growth in the financial system debt really took off after Reagan and shows that they have been feeding off of credit, hence the necessity of the zero fed funds rate, the special secret window etc etc.. The debt of the financial system looks like it went exponential since Clinton.

The present zero fed rate is aimed at returning these guys to profitability but any upward shift in the interest rate should send these guys falling back down to earth.

IMO the whole double dip talk is spin on how to save the financial industry, in fact the whole recovery effort has been about saving these guys and the expense of the real economy. Its why we are spending money to prop up values and inhibit deflation. Government policy has been set to cater to these guys and the media has been reporting as if a recovery for them is a recovery for all of us... we clearly that's a load of BS. They can call this a beauty mark but we all know its a wart and it has to come off.

wOW what a rebound

wOW what a rebound And in this graph you can see a steady increase in the financial industry as a percentage of GDP although they don't add anything to the economy as far as real product. they are parasites and make money from money.

And in this graph you can see a steady increase in the financial industry as a percentage of GDP although they don't add anything to the economy as far as real product. they are parasites and make money from money.