"tax the rich" isn't some punitive regime meant to harm the 'hard workers and risk takers'.

it's a simple fact that the top 10% most wealthy are almost universally engaged in regimes of tax avoidance and evasion. as soon as you get to a certain income bracket in the UK, it's de rigueur to hire a good financial advisor and to find as many ingenious and labyrinthine ways as possible of hiding and exempting your earnings. they are very, very good at it. it's been the name of the game since at least the yuppies 1980s hey-day.

https://www.independent.co.uk/news/busi … 66211.htmlWealthiest in Britain paying just 20 per cent tax rate, new research shows

https://www.theguardian.com/business/20 … t-tax-rateMore than 9,000 of the richest people in the UK collected more than £1m each in capital gains last year, exploiting a loophole that could result in them paying tax at a rate as low as 10%.

what do you think my chances are, as a humble freelancer making just above the national average salary, of finagling my tax returns so i only pay a 10% rate? as usual, the major asset-owning class can rely on the vast returns (relative to labour) on their assets to game the system and have everything exactly as they want.

the rich are taxed less than ever, at the individual and corporate level, in the West. and still we recycle these conversations about, 'wait a minute, increasing taxes on the rich? that's punishing success and innovation!' funny how our countries still innovated and produced successful people in the comparatively high-tax-burden eras up to now, isn't it?

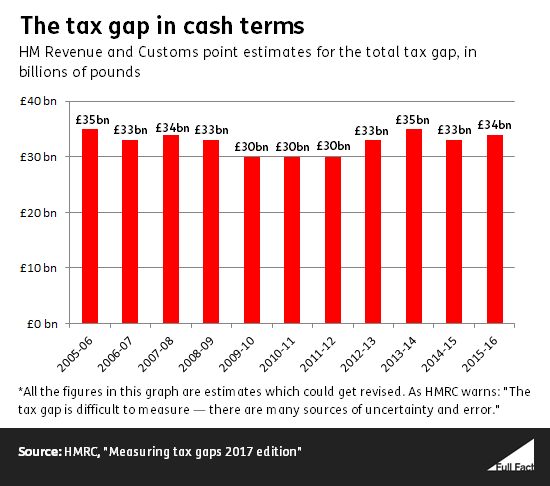

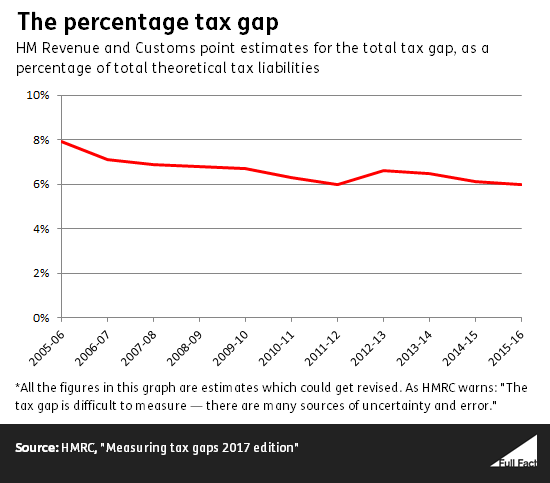

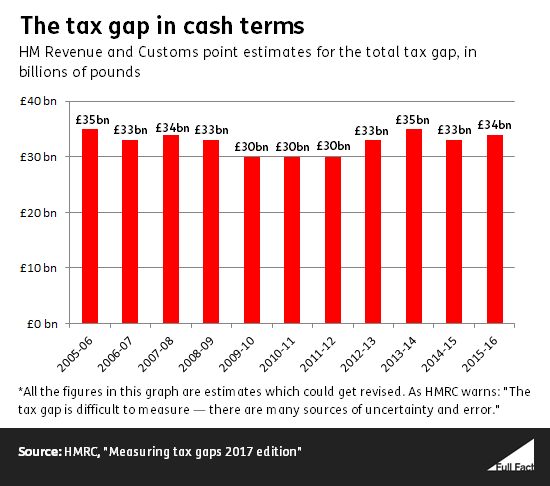

we don't need to immiserate the poor, pitiable rich by hiking their taxes to 1950s levels. we could raise an immense amount of money by closing tax loopholes, ending non-dom status, cracking down on shell companies and tax havens, etc. we lose near to 10% of our annual tax income this way!

https://fullfact.org/economy/tax-dodging/Richard Murphy, who runs the website Tax Research UK, estimated that the tax gap would be £122 billion in in 2014/15. HMRC currently estimates that the tax gap in that year was £33 billion.

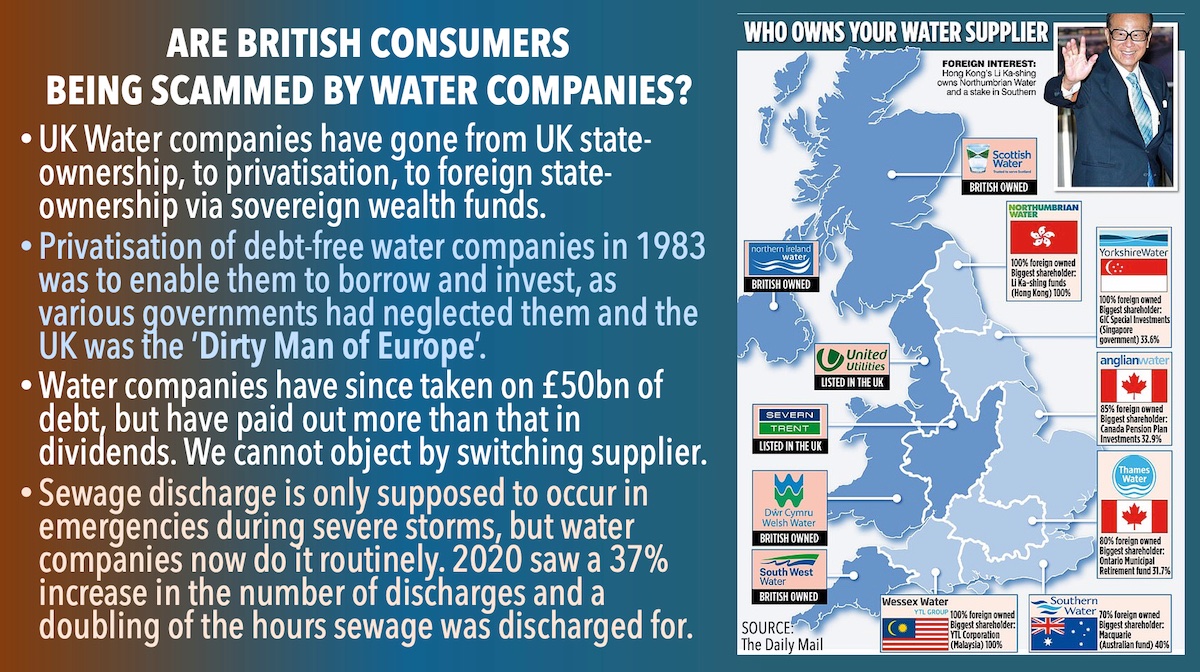

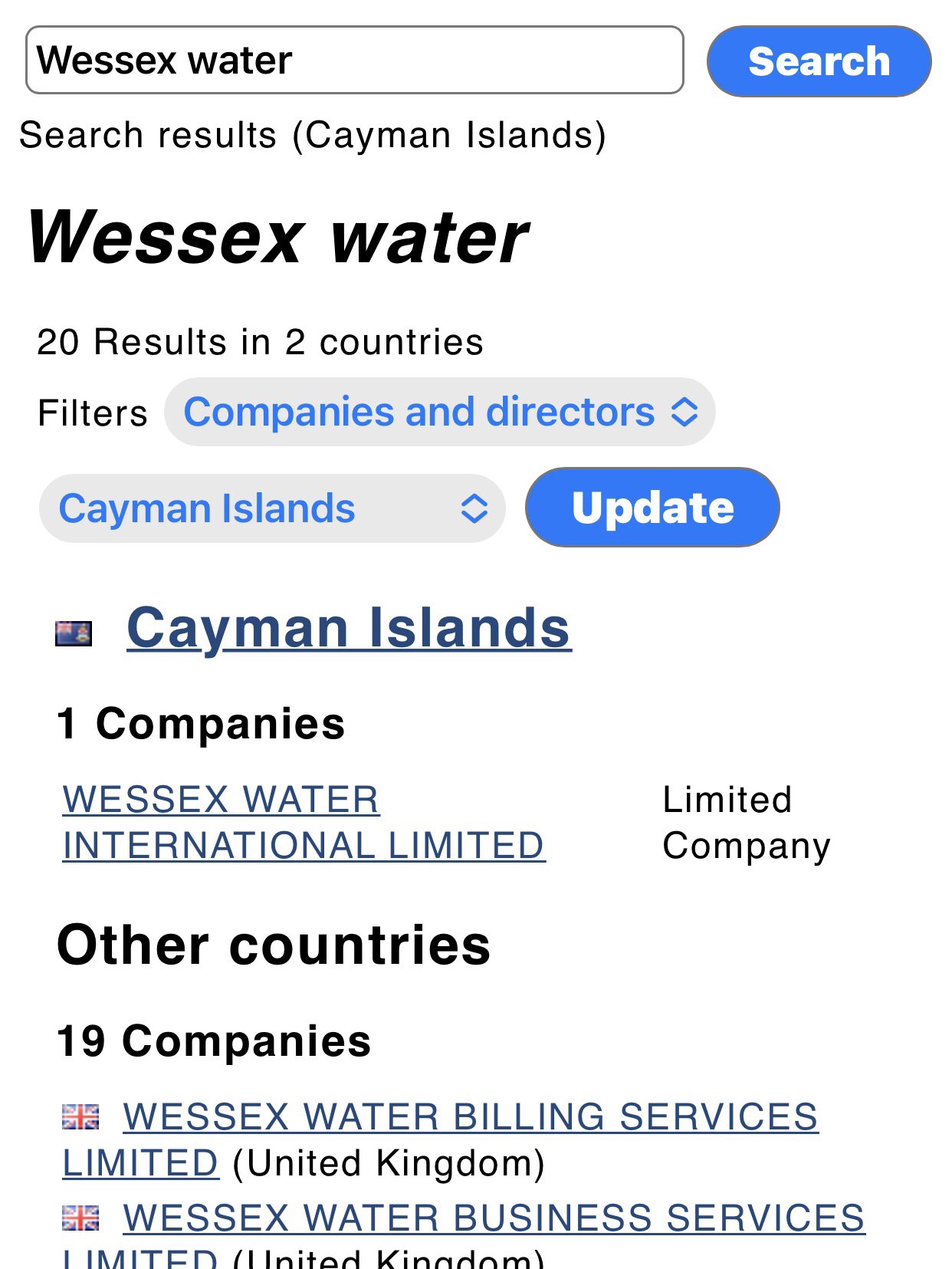

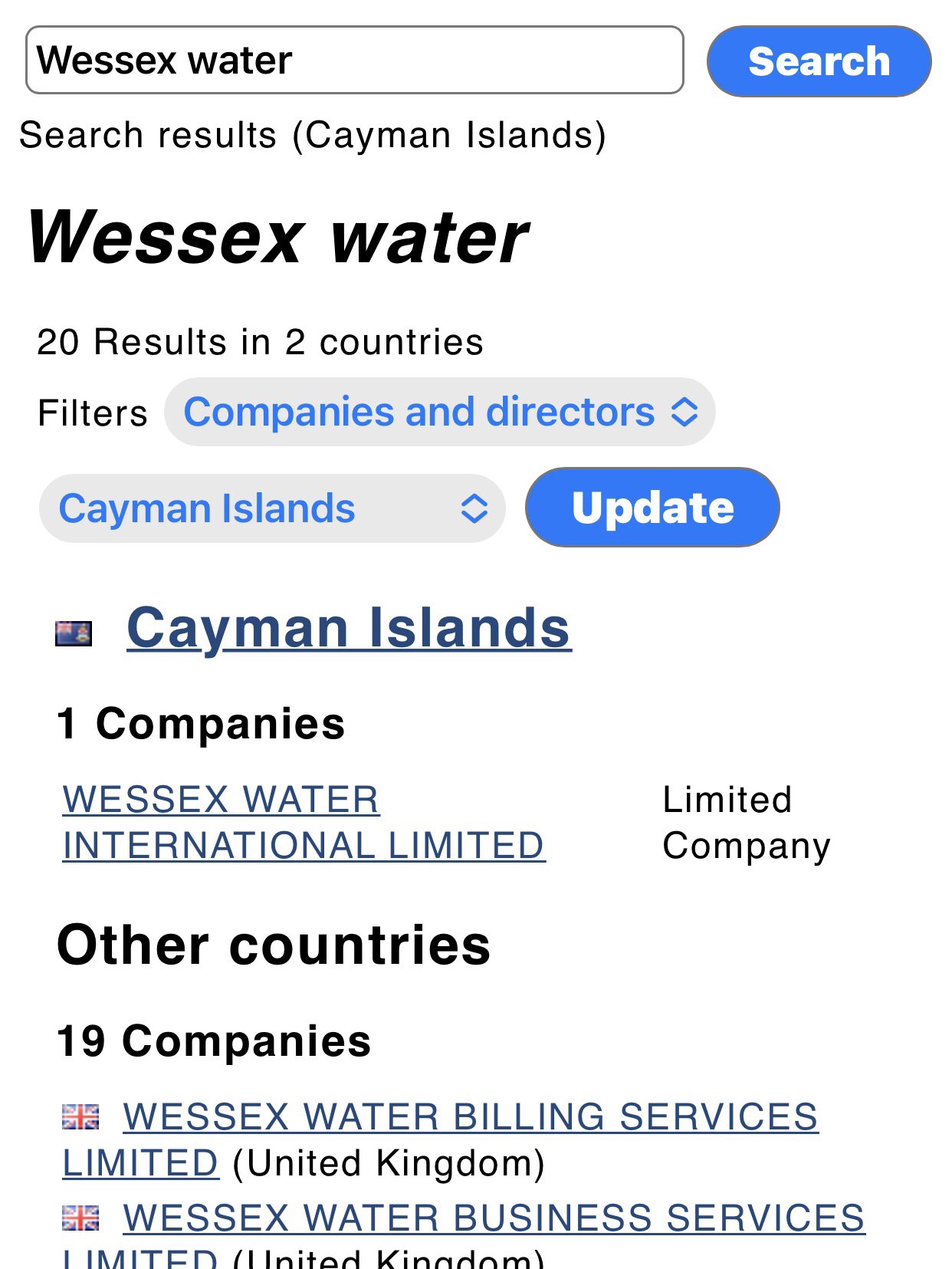

speaking of, isn't it ... odd ... that Wessex Water are registered in the cayman islands? i don't recall king alfred having ties to the caymans.

this is the status quo that needs to change, pure and simple. spare us your rhetoric about 'hurting high-achieving individuals'. most people who can afford to throw money into shares for private utilities companies have made out on a great generational gold-rush. that was what the 1980s thatcherite fire sales

were. a bunch of rich nobs getting in at the groundfloor on one of the greatest wealth transfer scams in generational history. sorry, but i don't have a lot of sympathy for your type, the 'at home day trader' who thinks they're the next rockefeller. the system isn't working for 90% of people. it needs change.

i have no left-wing revolutionary 'politics of envy', or a desire to see rich people suffer. i don't want to disincentivise success or risk-taking. that's just a red herring in these discussions. i want the rich to pay their fair share, as surely every worker does who is automatically docketed thru their PAYE salary each month does. no slimy schemes and no gaming the system; pay the amount you're due as a moral obligation to society. i don't even want to have to get into conversations about how the mega-wealth and profits of the rich are

generated off the labour of their workers, said workers who effectively pay higher rates of tax. the lower- and middle-classes are expected to fess up to the tax system fairly (and inescapably): the rich do everything they can to flout it.

Last edited by uziq (2022-08-17 04:29:30)